In this video I am going to answer the question ‘What are payments on account?’

If you have submitted a personal tax return, you may have heard the term ‘Payments on Account’, it’s one that can confuse a lot of business owners, so I am going to explain what it is layman’s terms.

When submitting a tax return, you can be earning un taxed income, which doesn’t need to be paid until nearly 9 months after the tax year.

If you’re in a job, you’re being taxed at source and being taxed every week or month, so payment on accounts are HMRC’s way of getting some of your tax early.

What are payments on account?

A payment on account is a payment of tax towards next tax years tax liability.

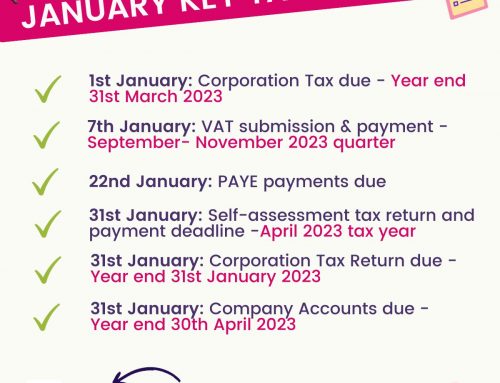

If you have a tax liability of more than £1000 you will need to pay payments on account. Which will be based on your tax liability for your current tax year. 50% of this needs to be paid by January 31st and the other 50% by 31st July.

Payments on account include class 4 national insurance if you’re self employed but not class 2, student loans or capital gains.

It can be a shock in your first tax year that triggers payments on account, because your tax payment is going to be a lot higher than normal.

These payments then get deducted from the following tax year’s liability.

Payments on account example

I will give you a simple example to highlight this. For the 2022-2023 tax year you have a £2000 tax liability, which would be due 31st January 2024.

On top of this liability, you would then have a £1000 payment on account due 31st January 2024 and £1000 due 31st July 2024. Then when you come to pay your 2024 tax liability, these two payments of £1000 would be deducted.

January 31st:

- £2000 tax

- £1000 1st payment on account

July 31st:

- £1000 2nd payment on account

When do you not have to pay payments on account?

You don’t have to pay payments on account if:

- Your tax liability is less than £1000 for the previous tax year.

- You paid 80% of your tax owed already, usually through your tax code like employment income.

Here’s the HMRC guidance on payments on account.

Final notes

If you don’t pay your payments on account and you have the tax liability HMRC predicted, you will accrue interest with HMRC.

If you think you’re going to have lower earnings than this tax year, you can reduce your payments on account.

If your tax liability is less than the two payments on account you made, HMRC will issue you a refund.

They can be penalising in your first year, but it’s not all bad, because you’re being organised and pre paying your tax liability for next year, which definitely makes it more manageable when you come to pay your tax liability, your future self will thank you!

If you need support submitting your tax return, check out the Self assessment tax return services or alternatively book a discovery call.

Leave A Comment