In this video I am going to show you how your payroll data gets posted into your accounting system and why it’s crucial that it does.

I was meeting a potential client in Costa this week who has payroll set up in their business, but had no idea whether that information was getting posted into Xero. Payroll is usually one of the larger costs to a business. If you’re running a profit & loss report, it’s important the payroll cost is in there.

It’s likely that either:

- You run your own payroll

- You have an accountancy practice running your payroll

- Or you work with a payroll bureau

Payroll reports

When the payroll is run, there will be a handful of reports published. It’s the email you probably instantly delete when it comes in.

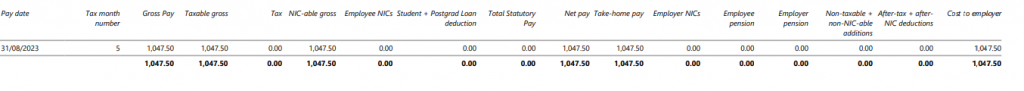

Here’s what the payroll report will look like:

Posting the payroll journal

You take the payroll report and either the business owner, bookkeeper or accountant needs to post a journal into your accounting system.

This is to reflect the cost in your profit and loss and to create the relevant HMRC and pension liabilities on your balance sheet.

So go into your accounting system and look if you have either director remuneration or a wages cost in your P&L.

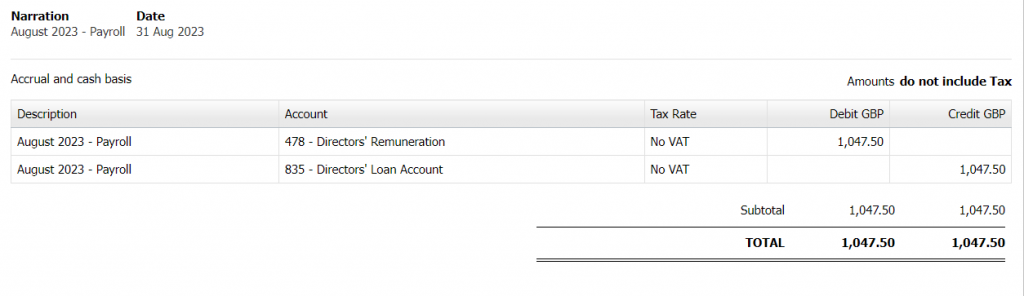

Here is an example of a salary journal that you would post for a directors only salary of £12,570. The Directors remuneration nominal goes as a cost on your P&L and in this case the liability is going against the Directors’ loan account.

In future months you may see a National Insurance liability.

If you’re not posting your payroll journals into your software, the information can’t be relied upon. It’s crucial that the payroll information is posted on a regular basis.

If payroll brings you out in a cold sweat, I can handle your payroll and the posting of the data, leaving you to focus on what you do best. Book a discovery call today to find out more.

Leave A Comment