Here is a handy list of all the UK tax dates 2024, so you know exactly which deadlines you’re working to.

Whether you run a Limited Company, you’re a sole trader, or need to submit a self-assessment with additional income, there are a lot of deadlines to keep track of.

Limited company UK tax dates 2024

When running a Limited company not only do you have HMRC commitments, but you also have to make submissions to Companies House as well.

For a Limited company, you have four main deadlines:

- Submitting your accounts to Companies House

- Submitting your corporation tax return to HMRC

- Paying your tax to HMRC

- Filing your yearly confirmation statement to Companies House

Limited company tax dates

Here’s how the key tax deadlines look when running a Limited company.

- Corporation tax due: 9 months and a day after your year end

- Corporation tax return due: 12 months after your year end

- Company accounts due: 9 months after your year end

- Confirmation statement: A year after your company formation date or last filing date, you then have 14 days to file.

Sole Trader and Self-assessment UK tax dates 2024

If you’re a sole trader or registered for self-assessment, there will two key deadlines with HMRC:

- Self-assessment submission and payment deadline: 31st January

- Payment on account deadline: 31st January and 31st July each year

UK tax dates and deadlines 2024

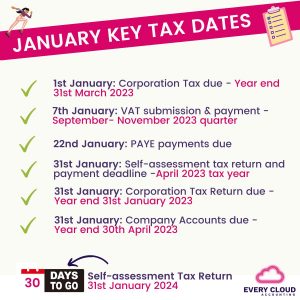

January 2024

- 1st January: Corporation Tax due – Year end 31st March 2023

- 7th January: VAT submission & payment – September- November 2023 quarter

- 19th January: CIS returns due – Month end 5th January

- 22nd January: PAYE payments due

- 31st January: Self-assessment tax return and payment deadline -April 2023 tax year

- 31st January: Self-assessment 1st payment on account due

- 31st January: Corporation Tax Return due -Year end 31st January 2023

- 31st January: Company Accounts due – Year end 30th April 2023

February 2024

- 1st February: Corporation Tax due – Year end 30th April 2023

- 2nd February: P46 (Car) form submission – Quarter ended 5th January

- 7th February: VAT submission & payment – October- December 2023 quarter

- 19th February: CIS returns due – Month end 5th February

- 22nd February: PAYE payments due

- 29th February: Corporation Tax Return due – Year end 28th February 2023

- 29th February: Company Accounts due – Year end 31st May 2023

March 2024

- 1st March: Corporation Tax due – Year end 30th May 2023

- 7th March: VAT submission & payment – November – January 2024 quarter

- 19th March: CIS returns due – Month end 5th March

- 22nd March: PAYE payments due

- 31st March: Corporation Tax Return due – Year end 31st March 2023

- 31st March: Company Accounts due – Year end 30th June 2023

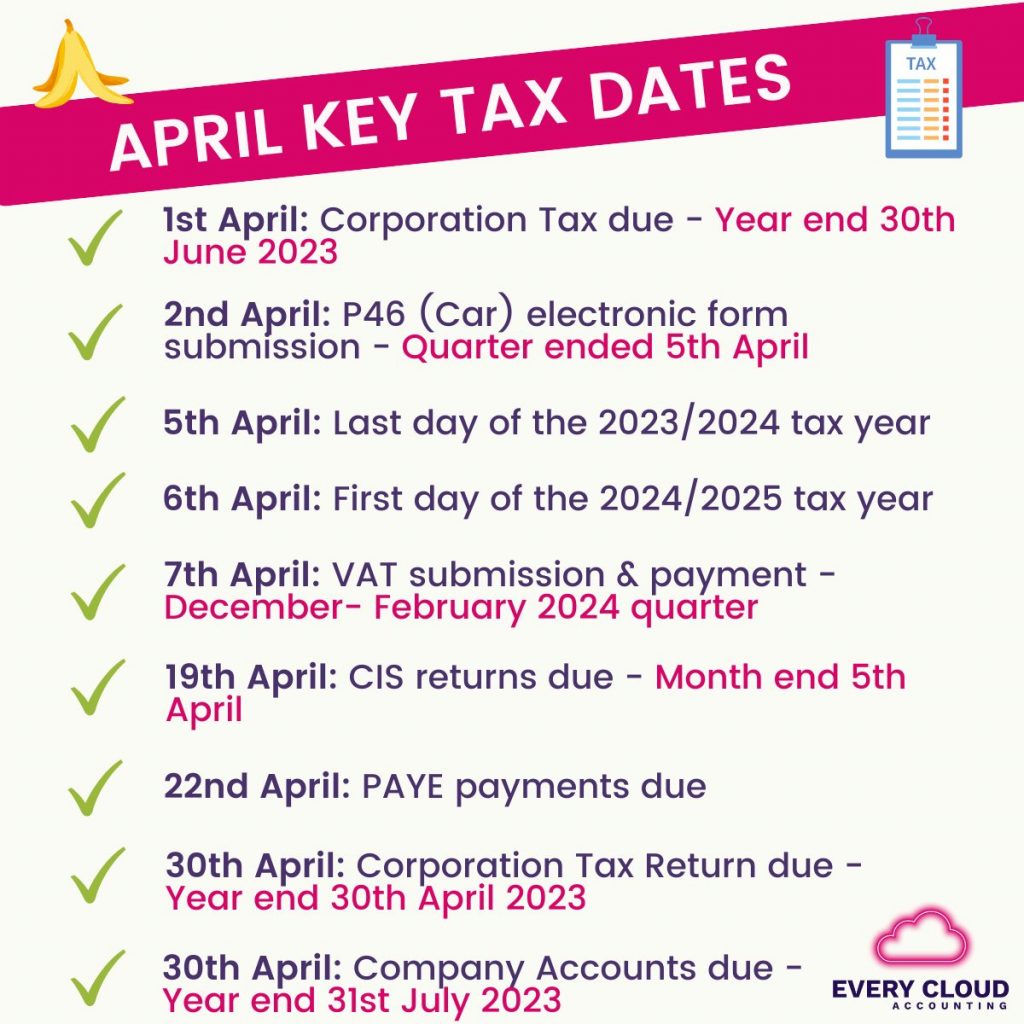

April 2024

- 1st April: Corporation Tax due – Year end 30th June 2023

- 5th April: P46 (Car) electronic form submission – Quarter ended 5th April

- 5th April: Last day of the 2023/2024 tax year

- 6th April: First day of the 2024/2025 tax year

- 7th April: VAT submission & payment – December – February 2024 quarter

- 19th April: CIS returns due – Month end 5th April

- 22nd April: PAYE payments due

- 30th April: Corporation Tax Return due – Year end 30th April 2023

- 30th April: Company Accounts due – Year end 31st July 2023

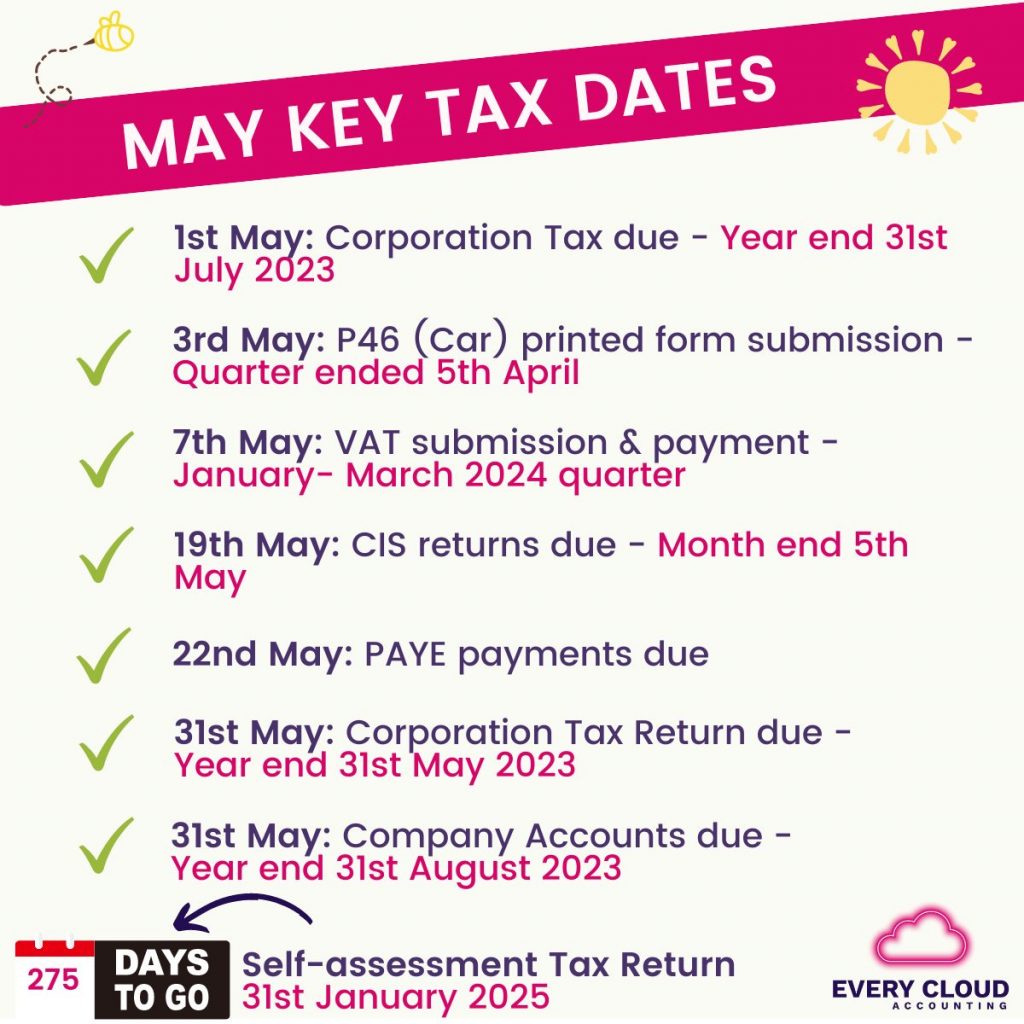

May 2024

- 1st May: Corporation Tax due – Year end 31st July 2023

- 3rd May: P46 (Car) printed form submission – Quarter ended 5th April

- 7th May: VAT submission & payment – January – March 2024 quarter

- 19th May: CIS returns due – Month end 5th May

- 22nd May: PAYE payments due

- 31st May: Corporation Tax Return due – Year end 31st May 2023

- 31st May: Company Accounts due – Year end 31st August 2023

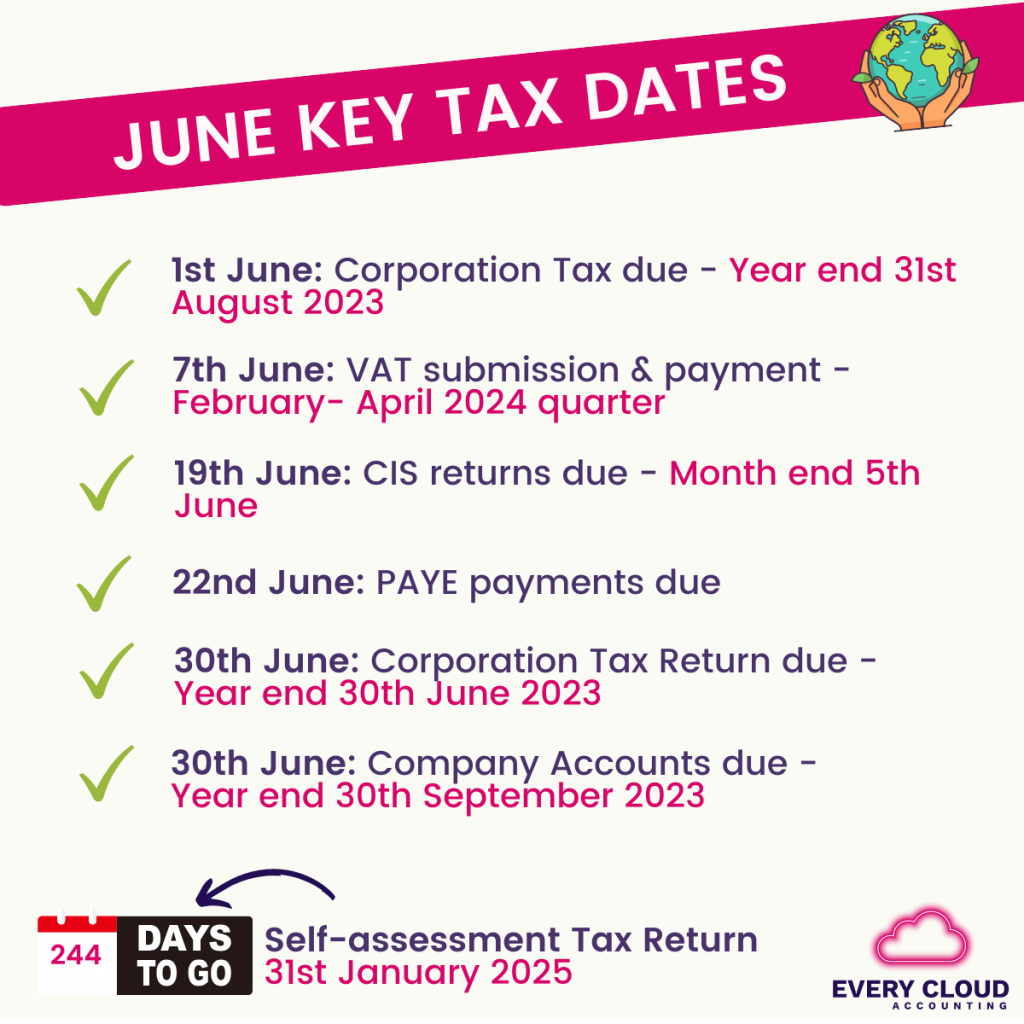

June 2024

- 1st June: Corporation Tax due – Year end 31st August 2023

- 7th June: VAT submission & payment – February – April 2024 quarter

- 19th June: CIS returns due – Month end 5th June

- 22nd June: PAYE payments due

- 30th June: Corporation Tax Return due – Year end 30th June 2023

- 30th June: Company Accounts due – Year end 30th September 2023

July 2024

- 1st July: Corporation Tax due – Year end 30th September 2023

- 6th July: 2024 P11D submission

- 7th July: VAT submission & payment – March – May 2024 quarter

- 19th July: CIS returns due – Month end 5th July

- 22nd July: PAYE payments due

- 31st July: Self-assessment 2nd payment on account due

- 31st July: Corporation Tax Return due – Year end 31st July 2023

- 31st July: Company Accounts due – Year end 31st October 2023

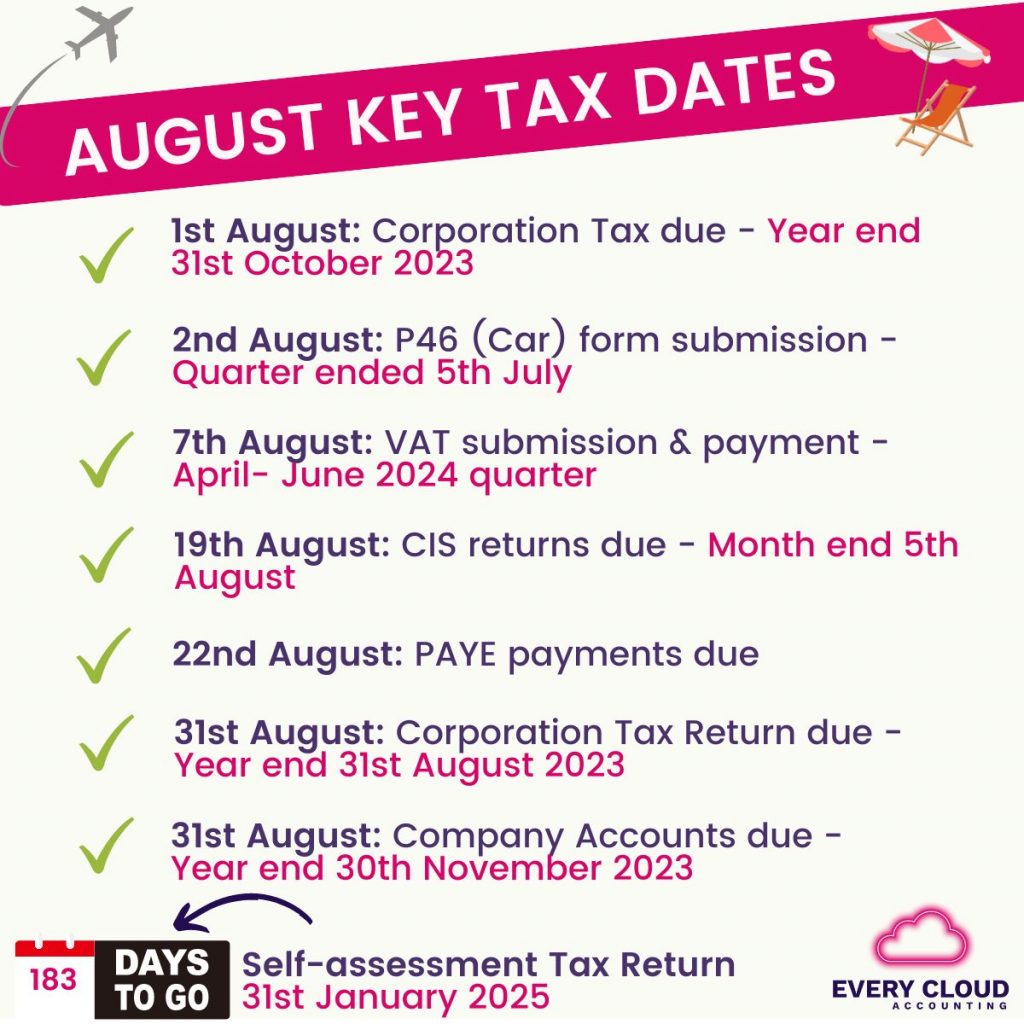

August 2024

- 1st August: Corporation Tax due – Year end 31st October 2023

- 2nd August: P46 (Car) form submission – Quarter ended 5th July

- 7th August: VAT submission & payment – April – June 2024 quarter

- 19th August: CIS returns due – Month end 5th August

- 22nd August: PAYE payments due

- 31st August: Corporation Tax Return due – Year end 31st August 2023

- 31st August: Company Accounts due – Year end 30th November 2023

September 2024

- 1st September: Corporation Tax due – Year end 30th November 2023

- 7th September: VAT submission & payment – May – July 2024 quarter

- 19th September: CIS returns due – Month end 5th September

- 22nd September: PAYE payments due

- 30th September: Corporation Tax Return due – Year end 30th September 2023

- 30th September: Company Accounts due – Year end 31st December 2023

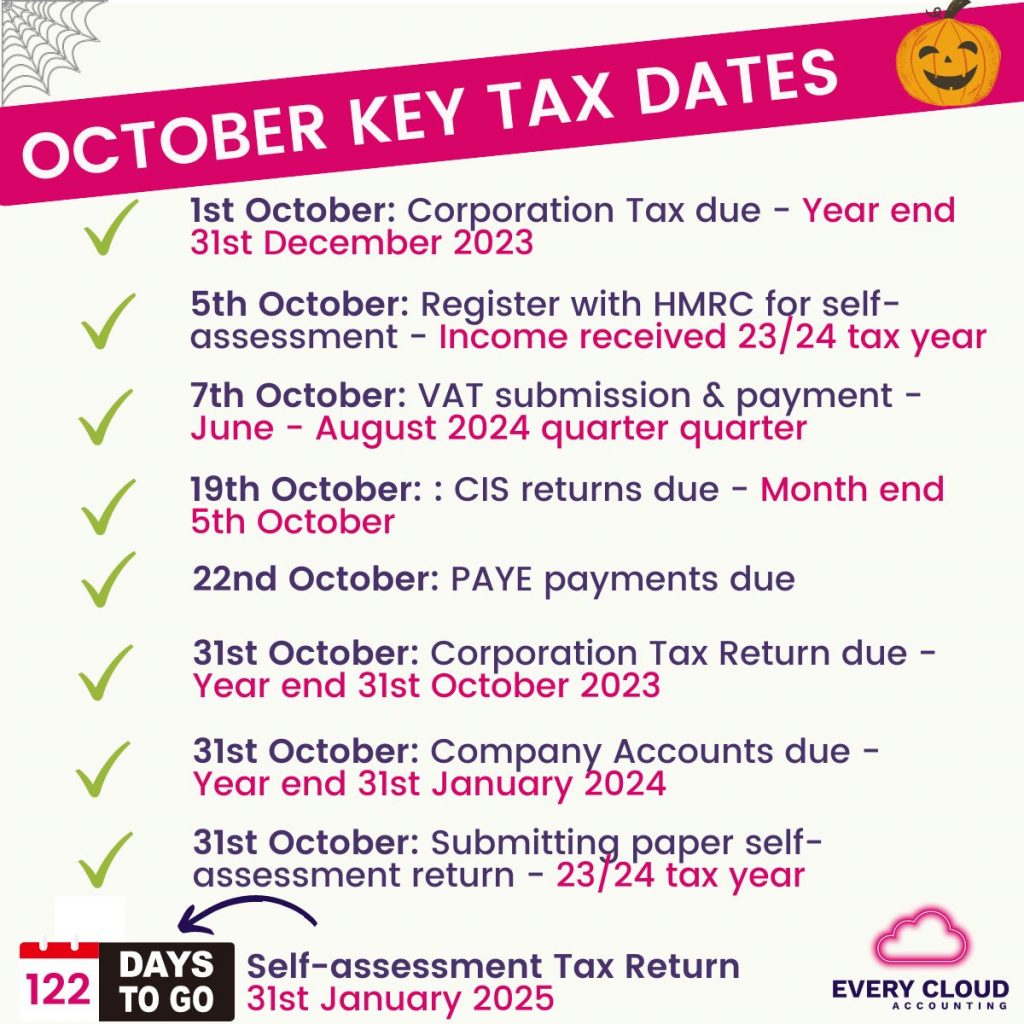

October 2024

- 1st October: Corporation Tax due – Year end 31st December 2023

- 5th October: Register with HMRC for self-assessment – Income received 23/24 tax year

- 7th October: VAT submission & payment – June – August 2024 quarter

- 19th October: CIS returns due – Month end 5th October

- 22nd October: PAYE payments due

- 31st October: Submitting paper self-assessment return – 23/24 tax year

- 31st October: Corporation Tax Return due – Year end 31st October 2023

- 31st October: Company Accounts due – Year end 31st January 2024

November 2024

- 1st November: Corporation Tax due – Year end 31st January 2024

- 2nd November: P46 (Car) form submission – Quarter ended 5th October

- 7th November: VAT submission & payment – July – September 2024 quarter

- 19th November: CIS returns due – Month end 5th November

- 22nd November: PAYE payments due

- 30th November: Corporation Tax Return due – Year end 30th November 2023

- 30th November: Company Accounts due – Year end 29th February 2024

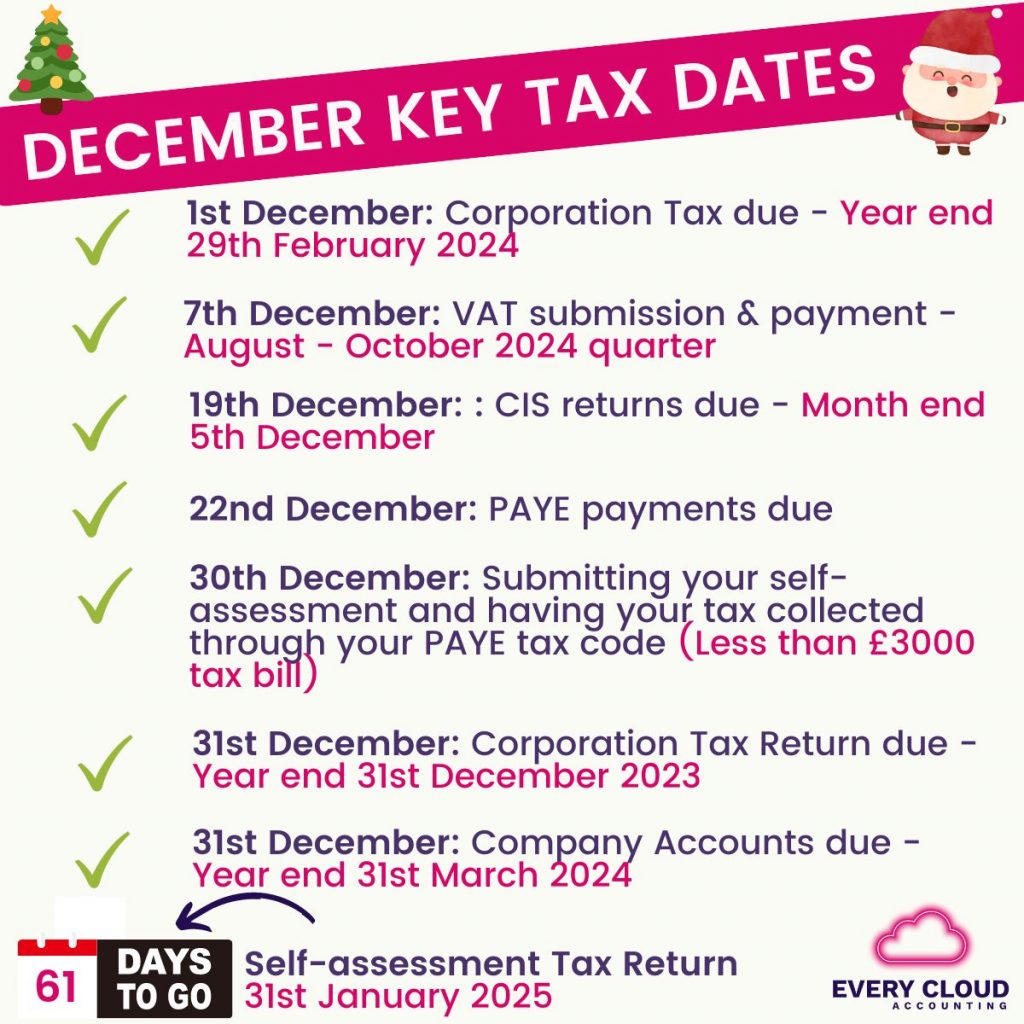

December 2024

- 1st December: Corporation Tax due – Year end 29th February 2024

- 7th December: VAT submission & payment – August- October 2024 quarter

- 19th December: CIS returns due – Month end 5th December

- 22nd December: PAYE payments due

- 30th December: Submitting your self-assessment and having your tax collected through your PAYE tax code (Less than £3000 tax bill)

- 31st December: Corporation Tax Return due – Year end 31st December 2023

- 31st December: Company Accounts due – Year end 31st March 2024

How to make tax payments

Here are the links to HMRC for more details on how to make payment:

If tax deadlines in your business are making your head spin and you want to work with an accountant to keep you on track, book a free discovery call today.