There are so many good reasons to submit your self-assessment tax return early.

Deadlines are a funny thing, I remember when I was at University, I would be set a piece of coursework for weeks, even months in the future and it would always be due on a Monday 4pm.

Guess when I would submit it? 3:59 pm – always a minute within the deadline everytime.

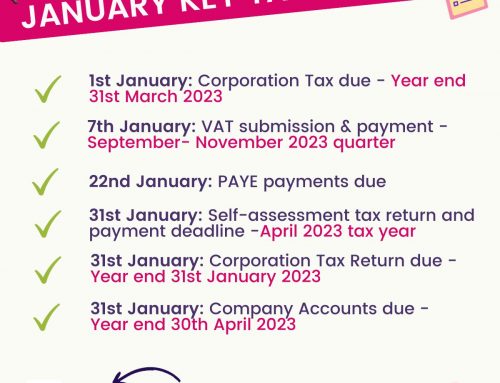

The tax year is 6th April to 5th April, with the online submission deadline being 31st January following the end of the tax year, nearly 10 months later.

For most people submitting a tax return, the 31st of January will be the date logged mentally, but you can submit your return straight after the tax year.

When you have a deadline window you naturally work towards the latest date.

For years I have seen people think about submitting their return in December and January, it’s a mad rush for everyone and things invariably go wrong.

This post is to persuade you to submit it now.

6 reasons why you should submit your tax return early

Here are the 6 reasons why you should submit your self-assessment tax return early.

- 10 months to save for your tax bill – Just because you submit your tax return early, you still have until 31st January to pay it. Doing it this way means you will have plenty of notice knowing how much you owe meaning you can save, make adjustments, and even have a push to increase sales to pay for your tax bill. When you have little notice, it can cause you to borrow, miss the payment deadlines and to generally make bad judgments.

- Know your 31st July payment on account – Payments on account are worked out based on your previous liability, it’s a HMRC prediction to pre-pay your tax liability. If you submit your tax return before 31st July, you’re going to know your exact liability, so if your income is less than the HMRC anticipated, you may not need to pay the full payment on account.

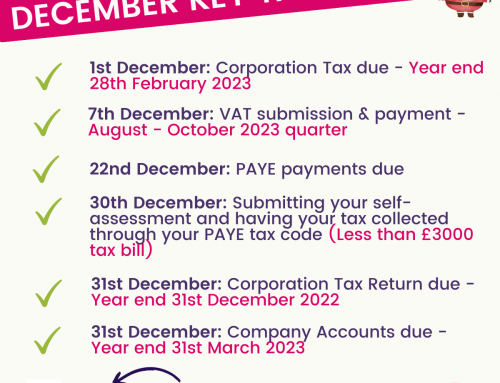

- No Christmas and New Year stress – You can sit back with a mince pie and your tipple of choice, knowing your tax return has been submitted. A client recently said to me, he usually prepares the information in the week after Christmas. What does that equal? Stress. If your return is submitted you can relax, knowing everything has been sorted. Also around Christmas time, finances are likely to be tight.

- The turnaround time is quicker – If you’re working with an accountant, guess when they are busiest? That’s right January. If you send over your information in June, they should love you for it and have a much quicker turnaround as they’re likely to be quieter. If you’re sending your information over in June and your accountant is not preparing your self-assessment until January, it might be time to find a new accountant. Early submission, requires both sides to be proactive.

- Have your tax collected through your tax code – If you have a PAYE salary and enough earnings to have the tax collected. If the return is submitted before 30th December and the tax liability is less than £3000, you can have it collected through PAYE, splitting the payments so you don’t have to pay a lump sum in January.

- You won’t be charged interest and penalties – Not everything goes to plan and sometimes there’s missing information, or a missing Unique Tax Reference (UTR), meaning the return can’t be submitted. If this is in July, it’s no biggy. If this happens on 31st January, you miss the deadline and can get charged interest and penalties, which no one wants.

Next steps to submit your tax return

Take some time to sit down, create a 2024 folder on your computer to start saving your tax return information, which could include copies of some of the following:

- Employment P60

- Pension P60

- P11D

- State pension

- Bank interest

- Dividends

- Capital Gains

- Child benefit information

- Student loan information

- Gift aid donations

- Sole trader profit and loss figures, or documentation with sales and expenses, including bank statements

- Rental income information – Rent received, expenses, bank statements, management statements

Further help with your self-assessment

Don’t put off your tax return and get it submitted now, I can promise you it will feel great.

If you want support from a proactive accountant, book a discovery call today. Or check out the self-assessment tax return page for more information.

Leave A Comment