Now that you’ve opened up day one on your advent calendar, here are some other dates that are going to be important in December.

If there was ever a month to get things submitted ‘early’ this would be the one!

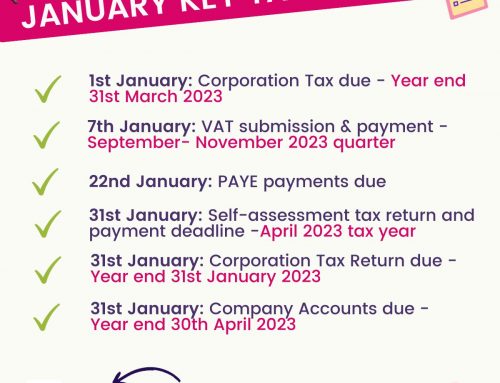

🚨 WARNING: 🚨There are now only 61 days until the self-assessment deadline. Giddy up and get that return in for Christmas.

HMRC links to make payment:

Here are the previous accounting deadlines:

As always if you have any questions, drop me a message and if you would like help with your self-assessment, don’t wait any longer.

Leave A Comment