You set up a Limited Company and there are endless taxes you must register for. You’re dealing with HMRC or Companies House and the letters are never ending.

I was there myself last year and it is overwhelming. The chances of you saving all the important references in a nice safe place are very thin.

But then you start working with an accountant, who will need all these references you then have no clue how to find them.

It slows down the whole process down and adds a lot of stress to your life, which you don’t need.

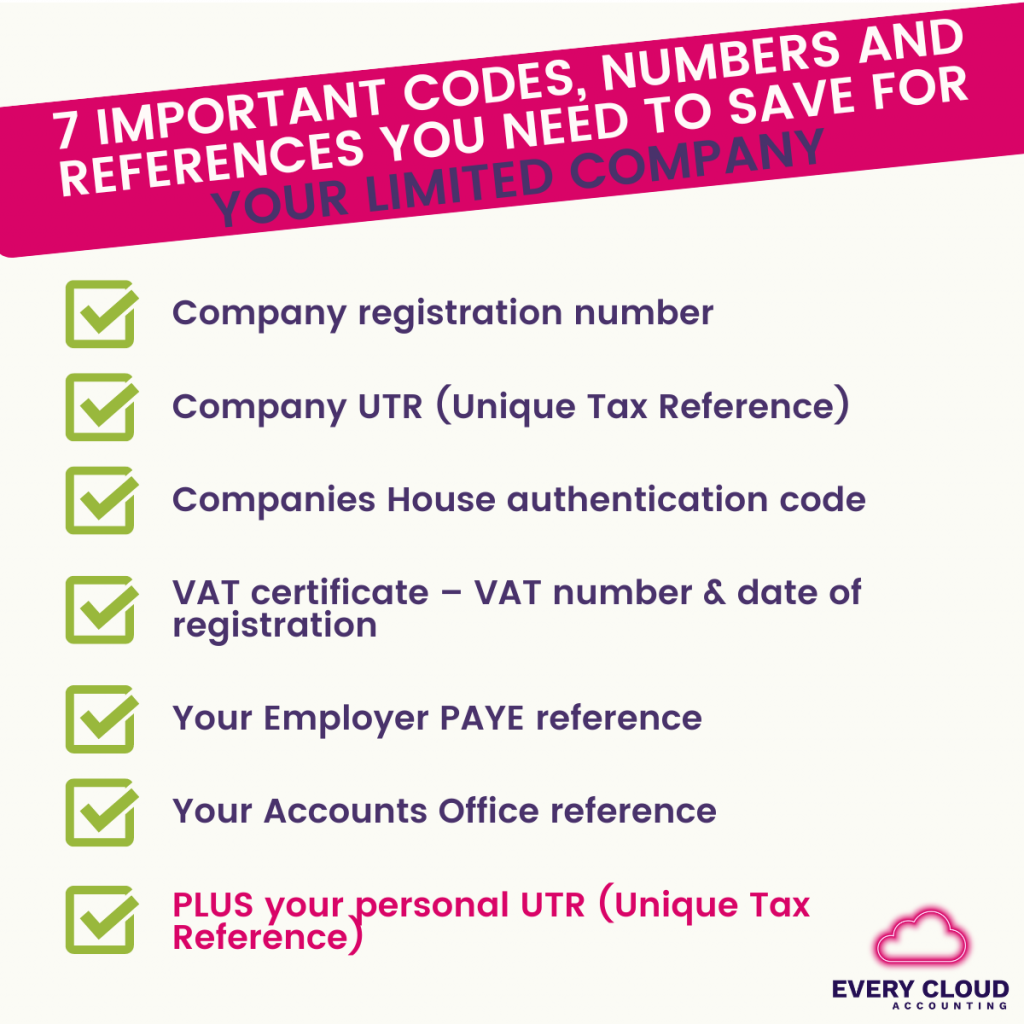

I am going to save you a lot of pain with a handy checklist below with the codes, numbers and references you need to save for your Limited company.

Here’s the PDF version to download: 7 important codes, numbers and references you NEED to save for your Limited

7 important codes, numbers and references you NEED to save for your Limited Company

- Company registration number

- Company UTR (Unique Tax Reference)

- Companies House authentication code

- VAT certificate – VAT number & date of registration

- Your Employer PAYE reference

- Your Accounts Office reference

- Personal UTR (Unique Tax Reference)

If you’re setting your business up, save a copy of the letter as you go. If you’re already set up, spend 15 minutes to compile these references, because I promise it will make your job easier down the line.

Obviously if you’re not registered for VAT or PAYE yet, these aren’t relevant to you, but they most likely will be at some point.

You can find these references either from:

- HMRC and Companies house letters

- On your HMRC gateway if the taxes are set up

- Calling HMRC or Companies House to re request

Companies House authentication codes are the most popular one that goes missing, here’s the Companies House link if you need to request yours (you need access to your filing account or you can set one up).

I hope the checklist is helpful, if you have any questions on how to track down any of the above, please just drop me a message and I will be happy to help.

Leave A Comment